The Role of Financial Self-Management for Independent Contractors

Independent contractors differ significantly from regular employees. The same organizational policies do not bind them; they are often free to work with multiple clients. This work model is prevalent in various fields, including technology, consulting, and creative industries. Contractors negotiate terms, rates, and deadlines with their clients, giving them control over how they approach their work. This independence is a double-edged sword: it provides flexibility but requires high discipline and self-motivation.

One critical aspect of being an independent contractor is managing financial documentation. Unlike employees, whose employers often withhold and manage taxes, contractors must handle their tax obligations. It includes keeping detailed records of income, expenses, and tax payments. Effective financial management is essential, as it ensures compliance with tax laws and provides a clear picture of one's financial health. This responsibility can be challenging but is crucial for the long-term success and sustainability of an independent contractor's career.

How Pay Stubs Help With Financial Self-Management?

Pay stubs play a crucial role in financial self-management for independent contractors, serving as valuable tools for several reasons.

Income Tracking

Pay stubs provide a clear record of income received from each client or project. This is essential for independent contractors who often juggle multiple clients and must track their earnings meticulously. Regularly reviewing pay stubs helps maintain an accurate income record, which is crucial for budgeting and financial planning.

Tax Preparation

For independent contractors, tax time can be complex due to the need to accurately report income to the IRS (Internal Revenue Service). Pay stubs serve as official documentation of earnings, assisting in accurately filing taxes. They help determine the total income earned over a fiscal year and can be used to cross-reference with bank statements for accuracy.

Expense Validation

Pay stubs can also aid in validating business expenses. Since independent contractors are responsible for their business costs, such as equipment, supplies, and travel, pay stubs can match income with outgoings, ensuring that all expenses are accounted for and justified.

Proof of Income

Independent contractors often face the challenge of proving their income when applying for loans, mortgages, or renting properties, as they lack the traditional proof of employment. Pay stubs serve as credible proof of income, demonstrating their earning capacity and financial stability to lenders and landlords.

Dispute Resolution

Pay stubs are a reliable source of evidence in case of discrepancies or client disputes over payment. They can be used to verify the amount paid and the payment date, essential in resolving any financial misunderstandings or legal disputes.

Financial Analysis and Growth Tracking

Regularly reviewing pay stubs allows independent contractors to analyze their financial progress. They can identify trends in their income, understand peak seasons, and plan for slower periods. This analysis is crucial in strategizing for business growth and sustainability.

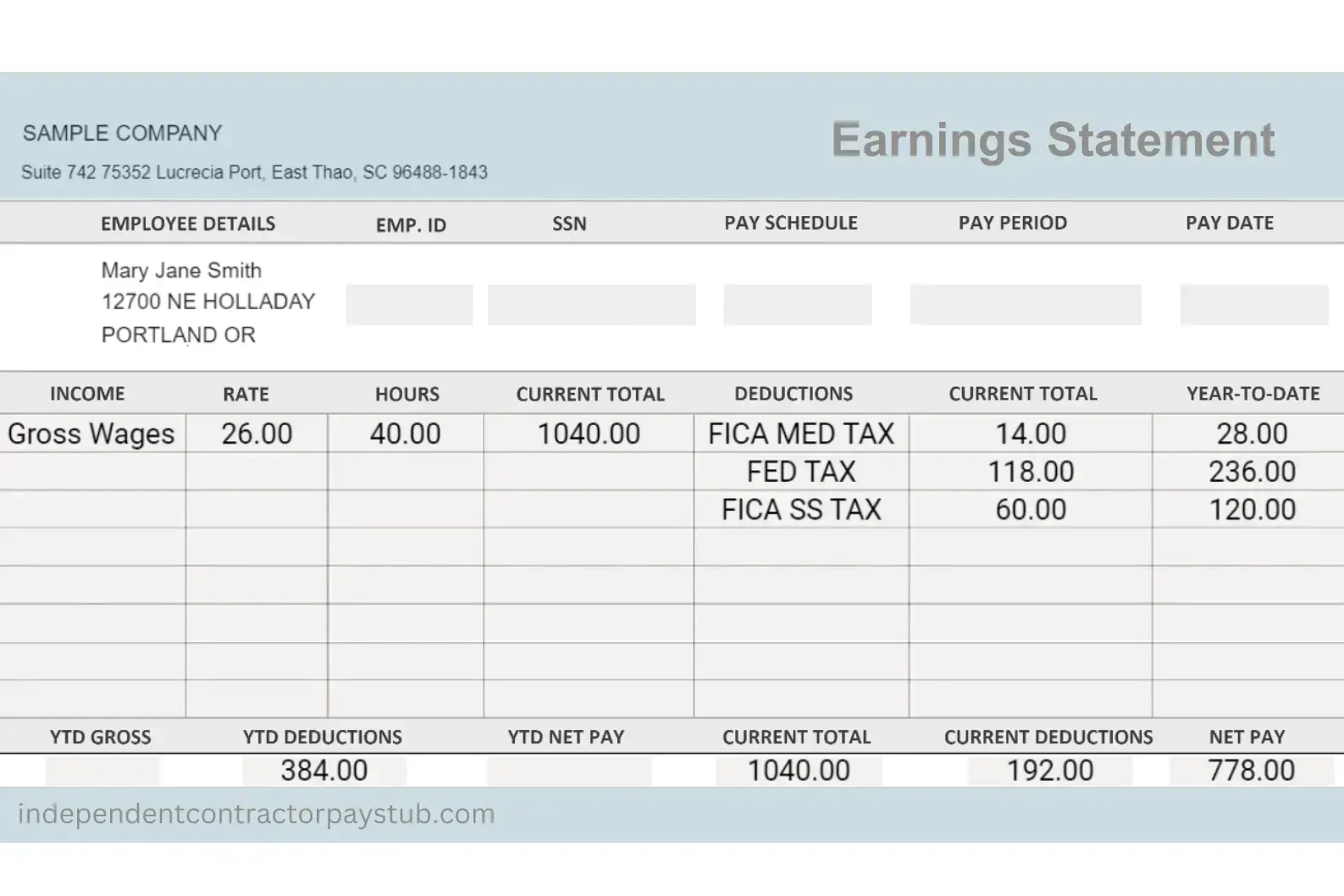

Key Elements of an Effective Pay Stub Template

An effective pay stub template for independent contractors should include payment details and other essential elements to ensure clarity, accuracy, and compliance with financial and legal requirements. Here are the key components:

- Contractor's Information. It includes the contractor's full name, address, and possibly the tax identification number (TIN) or Social Security Number (SSN).

- Client's Information. Similar to the contractor's details, this section should have the client's name and address, clearly indicating who the payment is from.

- Payment Period. The specific date or period for which the payment is being made. It could be a single one or a pay date for the services.

- Gross Pay. The total amount earned before any deductions. It might include hourly rates, fixed project fees, or other forms of payment agreements.

- Deductions. Although contractors typically handle their taxes and insurance, any agreed-upon deductions (if applicable) should be itemized. It could include specific project expenses or other agreed deductions.

- Net Pay. The actual amount received by the contractor after deductions (if any).

- Payment Method. Indication of how the payment was made (e.g., check, direct deposit, electronic transfer).

- Invoice or Project Reference. A reference number or description linking the pay stub to a specific invoice or project for easy tracking and record-keeping.

Creating organized pay stubs is vital for independent contractors; a well-structured template makes this easier. Simplicity in design is critical to avoiding confusion and minimizing errors. Accuracy in every entry, especially financial figures, is crucial to prevent discrepancies that could affect tax filings or client relationships.

Advantages of Using an Independent Contractor Pay Stub Template

Using a simple pay stub template offers significant advantages for independent contractors. This is a blend of efficiency, accuracy, and simplicity in managing their financial affairs. Let's take a closer look at why you should use a blank pay stub template.

Efficiency in Financial Management

Using the right pay stub template streamlines the financial management process for independent contractors. It allows for quick and accurate calculations of earnings and deductions, saving time and reducing the likelihood of errors. This efficiency is crucial in maintaining up-to-date financial records.

Accuracy in Financial Record-Keeping

A comprehensive paycheck stub template ensures accuracy in financial record-keeping. A consistent format for documenting income and expenses helps maintain precise and orderly financial records, essential for personal financial management and professional accountability.

Simplification of Tax Reporting

A well-structured pay stub template simplifies tax reporting. It provides a clear breakdown of income and deductions, making it easier to file accurate tax returns. So, professional pay stubs are particularly important for independent contractors responsible for their tax obligations.

Enhanced Financial Tracking

Pay stub templates aid in better financial tracking. They offer a systematic way to monitor earnings over time, enabling contractors to analyze their financial health and plan for future financial goals. This organized approach to financial tracking is invaluable for long-term financial planning and stability.

Considerable Time Savings

Pay stub generator is a significant time-saver. You will no longer have to create documents manually. This tool streamlines the process of generating pay stubs, dramatically reducing the time required to compile and calculate earnings and deductions. This time efficiency is invaluable for independent contractors, as it frees up more hours dedicated to their core business activities.

How to Create Professional Pay Stubs: A Step-by-Step Process

Creating a pay stub can seem daunting, but it's a straightforward process with the right approach. Whether you're an independent contractor or managing payroll for a small business, following these steps will help you produce accurate and professional-looking pay stubs.

Choosing the Right Template

The first step is selecting a basic pay stub template. Choose a form that is not only visually clear and easy to read but also aligns with the specific needs of your business. It should include fields for all the necessary details, such as earnings, deductions, and net pay. Consider customizable pay stub templates, allowing you to adapt them to your unique requirements.

Detailing Earnings Accurately

Once you have your pay stub template, the next step is to detail earnings. It includes entering the exact amount of income earned in the pay period. It could mean hourly rates, project fees, or other payment agreements for independent contractors. Accuracy is crucial to ensure that all earnings are correctly recorded and reported.

Calculating Deductions Precisely

Deductions are an essential component of a basic pay stub. These could include any taxes, insurance, or other agreed-upon deductions specific to the contractor's situation. Double-check each deduction carefully and list them clearly on the pay stub to avoid confusion and ensure transparency.

Determining Net Pay

This is the amount the contractor takes home after all deductions are made from the gross earnings. Ensure that this calculation is done precisely, as it represents the actual income that the contractor will receive. Remember that gross and net pay is critical for the contractor's personal budgeting and financial planning.

Avoiding Common Mistakes in Pay Stub Generation

Generating accurate pay stubs is essential for financial transparency and compliance. It's important to be aware of and avoid common mistakes to ensure their reliability.

A common error in pay stub generation is incorrect data entry, including miscalculated hours worked or wrong payment rates. Prevent these errors by double-checking all entered data against records or contracts. Use digital tools that automatically calculate all figures to reduce human error. Additionally, ensure all necessary information, such as deductions and net pay, is correctly listed.

Consistency in pay stub format and content is crucial. Inconsistencies can lead to confusion and mistrust. Use the same template for all pay stubs and ensure that all fields are filled in the same manner each time. This consistency aids in easy comparison over time and helps maintain orderly financial records.

Accuracy is paramount when you create pay stubs. Inaccuracies can lead to financial discrepancies, legal issues, and tax filing problems. Accurate documentation of earnings and deductions is a legal requirement and a best practice for transparent and ethical financial management.

The Bottom Line

In conclusion, using pay stub templates greatly enhances financial management for independent contractors. These tools offer clarity, accuracy, and efficiency in financial record-keeping. By using templates, contractors can ensure their financial documentation is consistent and professional, aiding in tax preparation and client interactions. This practice streamlines financial management and bolsters credibility and trust in professional relationships.

Therefore, independent contractors who want to maintain strong financial health and professional credibility should use these tools, especially focusing on how to generate pay stubs effectively using customizable templates.

Related Posts

Explore the provided links for valuable insights and guidance on effectively managing pay stubs for independent contractors:

- How Pay Stubs May Empower Independent Contractors

- Step-by-Step Guide: Creating Pay Stubs for Independent Contractors

- The Anatomy of Independent Contractor Pay Stubs

- Streamlining Employee Details for Independent Contractor Pay Stub

- Securing Employee Data: Independent Contractor Pay Stub Strategies

- Ensuring Pay Stub Precision: Lessons from Common Contractor Mistakes

- Understanding Legal Obligations for Contractor Pay Stubs

- The Advantages of Digital Pay Stubs for Contractors

- Prioritizing Safety: Inclusion of Emergency and Medical Data on Pay Stubs

- A Guide to Federal Tax Withholdings on Contractor Pay Stubs

- Independent Contractor's Handbook on Social Security and Medicare Taxes

- IRS Reporting Essentials: Contractor Earnings Made Simple

- Tax Deductions Every Independent Contractor Should Know

- Pros and Cons of Self-Employment: Is Independent Contracting Suitable for You?

- Independent Contractors' Roadmap to Insurance and Benefits

- How Project's Duration Shapes Independent Contractor Compensation

- How to Improve Terms in Contract Renewal or Extension for Independent Contractor

- Comparing Full-Time Employment to Independent Contracting

- Legal Perspectives on Ending Independent Contractor Arrangements

- The Vital Role of Independent Contractor Pay Stubs

- The Key Elements of Job Descriptions for Independent Contractors

- The Contractor's Guide to Payment Terms

- Resolving Disputes in Independent Contractor Arrangements

- Legal Guidelines for Overtime and Work Hours for Contractors

- Empowering Contractors with Confidentiality Clauses in Pay Stubs

- Digital Solutions for Contractor Pay Stubs: A Comprehensive Guide

- How Independent Contractors Can Perfect Their Schedules

- Essential Guidelines for Independent Contractor Workplace Security

- Renewal and Termination: Best Practices for Independent Contractors

- Protecting Your Finances: The Role of Pay Stub Verification

- The Contractor's Guide to EIN: Understanding Its Crucial Role

- Comparing EIN vs. SSN – The Breakdown

- Applying for an EIN: Step-by-Step Guide

- Everything You Need to Know About Managing Independent Contractors